Loss Control Systems can be key to unlocking the hidden value of your loss control team. A successful system can:

- Increase efficiency and morale across the team

- Allow you to make smarter business decisions and target accounts more effectively

- Enable you to better service your clients, increasing their overall engagement and retention rates

(For more insight on unlocking the value of your loss control data, check out our blog on the topic here).

Unfortunately, too many companies don't realize there are Loss Control Systems available today that allow you to achieve this. Sometimes companies already have a system (perhaps a custom or homegrown system) that has limited functionality, and the team believes this is the full extent of a loss control system’s capabilities.

Working with over 75+ insurance companies today, we have seen quite a few variations of systems, from word documents and excel sheets, to SharePoint sites, to advanced custom built systems.

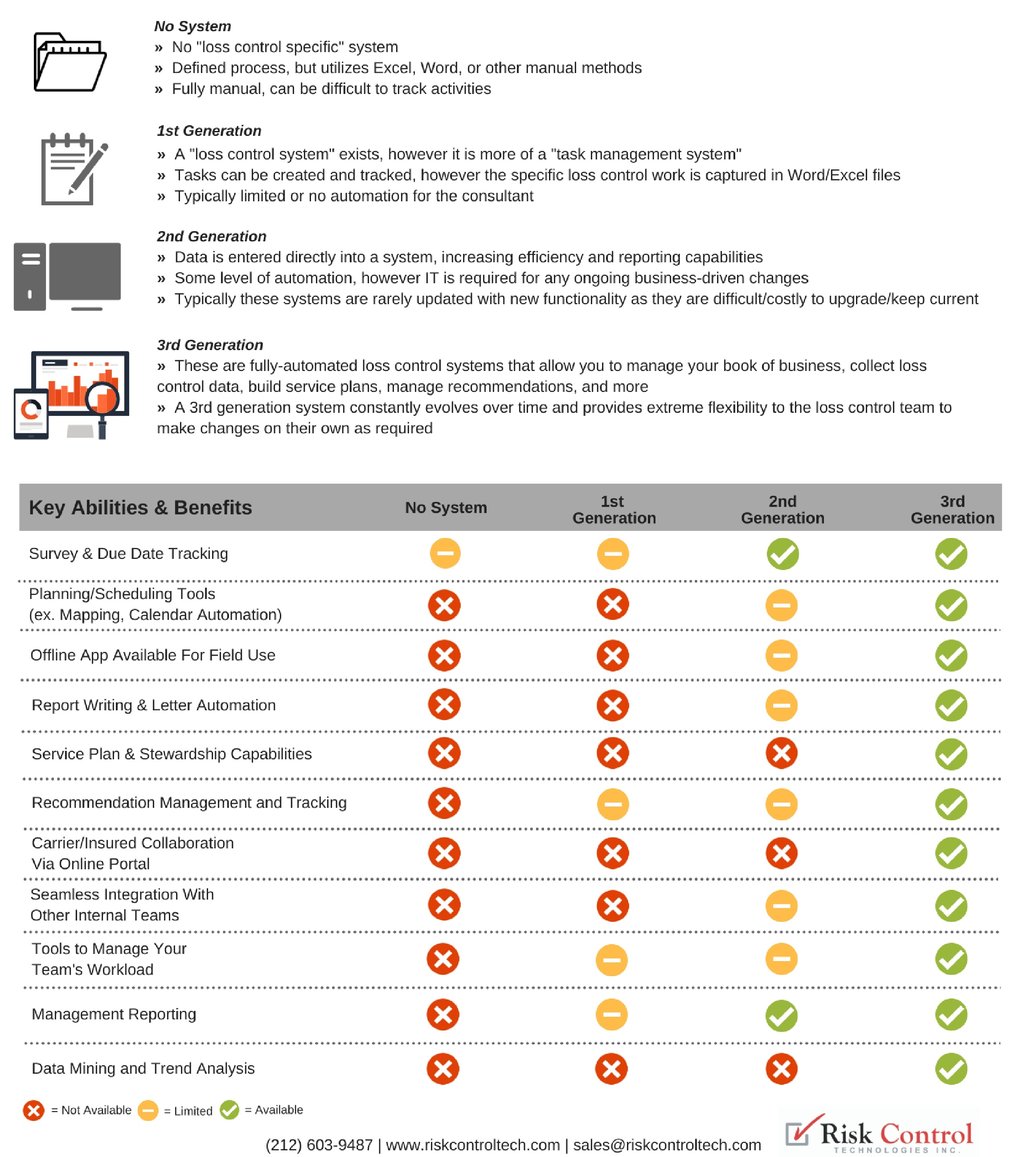

To help provide insight on what capabilities are available today, we have provided some context below on the various types of loss control systems:

Let's summarize a few of the most important benefits of a 3rd generation system:

Efficiency, Flexibility and Ongoing Improvements:

- With the system handling all of your loss control workflow, there is no duplicate entry, report and letter generation is automated, and all manual processes are streamlined

- IT is no longer required to make changes to your day-to-day business (ex. collecting new data fields, changing your recommendation letters, etc.). The Loss Control team can now make changes whenever required, and no longer need to compete with other internal IT priorities/projects

- A 3rd generation system continuously evolves, so your team always stays current with new risk control features and concepts

Data Mining, Analytics, and Business Intelligence:

- By consolidating loss control data into one centralized system and having access to a powerful reporting tool, the team can now explore new opportunities:

- Analyze their loss control data with claims data to identify where losses are coming from, what type of accounts are at risk and what safety programs are being effective

- Build client profiles to identify similar types of accounts, build specific service plans and then monitor the results on those clients

- Analyze their recommendation history to determine the most common issues/recommendations across their clients, allowing them to tailor additional safety resources and programs to those high impact areas

The Insured Relationship and Customer Engagement:

- There is increasingly more support in the industry that increased engagement leads to better retention rates, and ultimately, higher profitability (for more information, check out the 'Account Retention' section of our white paper, Loss Control as a Competitive Advantage).

- 3rd generation systems increase customer engagement in a variety of ways:

- Providing an online portal allowing for new ways to engage/increase touchpoints with an insured

- Allowing you to facilitate self-assessment surveys with clients (ex. have low premium accounts fill out an online survey so you can determine their risk profile)

- Enable you to publish safety resources (and track the insured's engagement with them)

Have any questions? We'd love to discuss your current system and workflow, don't hesitate to contact us!