RCT named as one of the world’s most innovative InsurTech companies that every leader in the insurance industry needs to know about.

In a rapidly evolving world where technology continues to reshape industries, the insurance sector has not been exempt. The rise of InsurTech companies has brought innovative solutions to the insurance landscape. Among these pioneers, Risk Control Technologies is honoured to have been named for the second consecutive year on the InsurTech100 list, a testament to the company's commitment to transforming the insurance industry through cutting-edge technology.

About the List

The InsurTech100 list is a prestigious group of the world's most innovative InsurTech companies, selected from over 1,900 nominees. Published annually by FinTech Global, this list highlights the most promising and disruptive InsurTech firms that are revolutionizing the insurance industry. Being included in this exclusive list is not only an acknowledgment of a company's innovative approach but also a testament to its potential to shape the future of insurance. A range of factors are considered to build the final list, including:

- Industry significance of the problem being solved

- Growth, in terms of capital raised, revenue and customer traction

- Innovation of technology solutions

- Potential cost savings, efficiency improvement, impact on the value chain and/or revenue enhancements generated for clients

- Importance of insurance executives knowing about the company

Innovation at Risk Control Technologies

Risk Control Technologies (RCT) is a company that stands out among the InsurTech crowd. Established with a vision to enable underwriters and loss control teams to capture risk data from all sources in a single pane of glass and enhance the risk management process, RCT combines a unique blend of deep expertise in loss control and cutting-edge technology.

Today, RCT helps a rapidly growing community of over 150 insurance organizations to improve their loss ratios, increase customer retention, implement operational efficiencies, and harness powerful data insights to enable better business decisions.

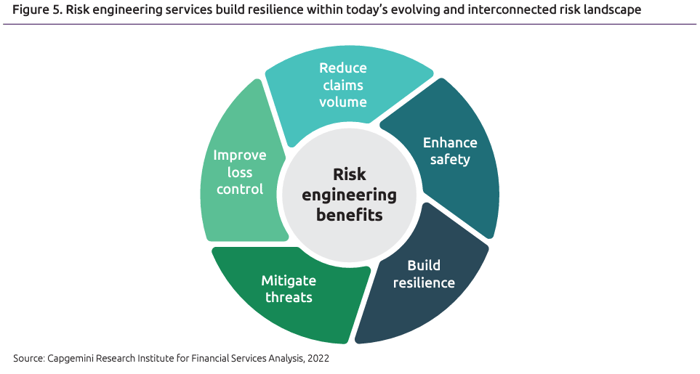

Furthermore, focus on loss control and risk engineering are picking up steam in the Property & Casualty space, in part spurred by supply chain challenges, climate events, and global inflationary concerns. Capgemini's report, Top Trends in Property and Casualty Insurance 2023, focuses heavily on Risk Engineering, as well as how some commercial insurers are creating new revenue streams through these services.

"Risk engineering adds an essential layer of protection for commercial policyholders by providing comprehensive solutions before, during, and after an event. Additional benefits include superior fraud management, underwriting, and decision-making" - Capgemini.

Speaking to RCT's inclusion on the 2023 list, RCT CEO David Da Costa stated "we're thrilled to be included amongst this group of leading tech providers for a second time. It's a testament not only to our company, but to the importance of loss control teams and professionals as companies navigate a tumultuous insurance and economic environment".

To learn more about RCT contact us at sales@riskcontroltech.com, or click below to access an RCT Whitepaper on leveraging loss control as a competitive advantage.

.png?width=500&height=500&name=Whitepaper%20Ads%20-%20Loss%20Control%20as%20a%20Competitive%20Advantage%20(1).png)