Recently Datos Insights, formerly known as Aite-Novarica, hosted a panel discussing the ‘new insurance core ecosystem’. Datos Insight’s Head of P/C Insurance Martina Conlon was joined by Risk Control Technologies Inc. (RCT) CEO, David Da Costa, and Skyward Specialty Insurance’s VP Loss Control, John Greco.

To watch the full webinar, please click here.

In this webinar Datos singled out loss control as an ideal choice for a P&C insurers next highest priority project, due to the direct impact risk data has on improving combined ratios, optimizing premium pricing, and measurably impacting the customer experience.

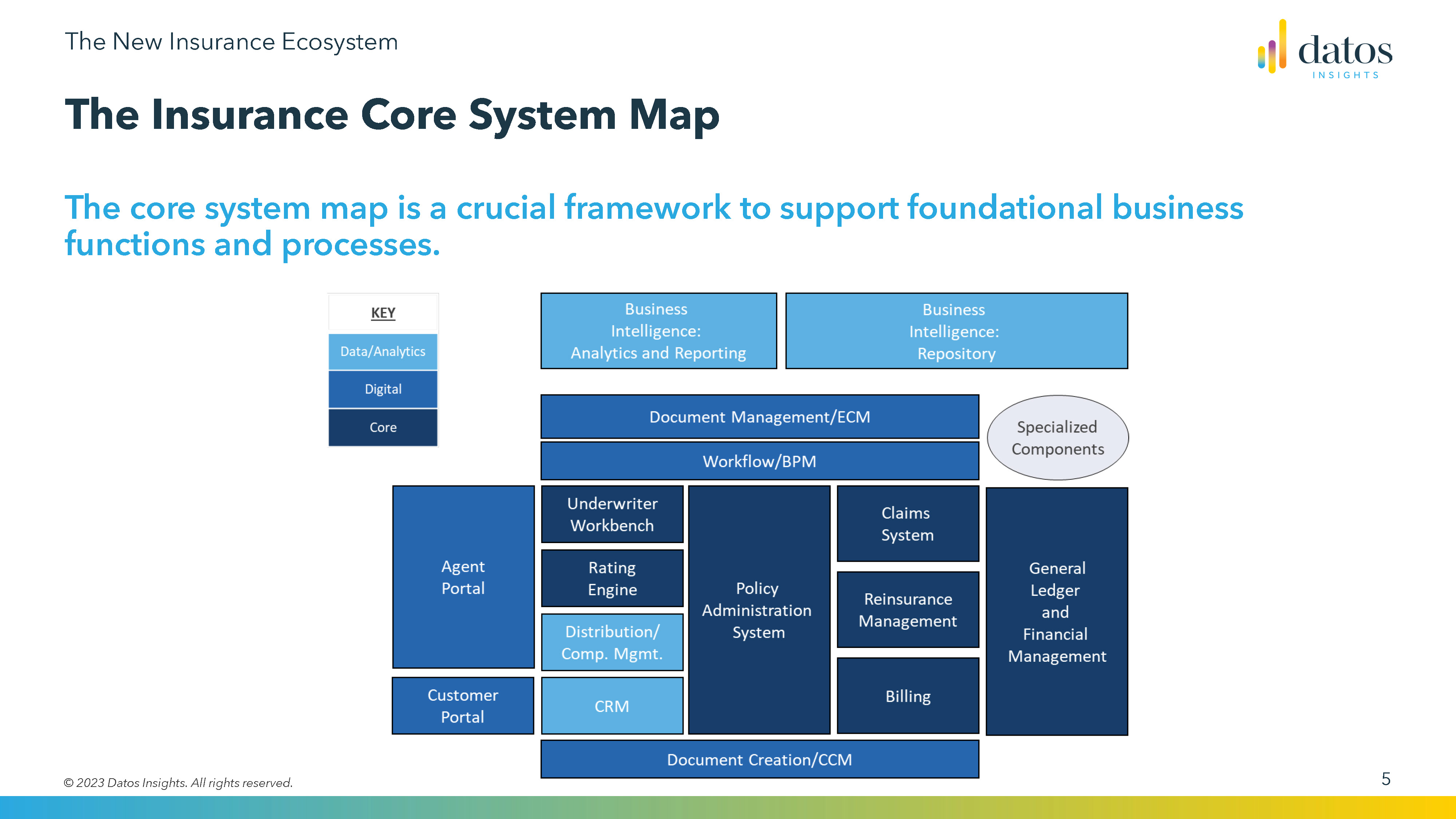

Conlon discussed the critical importance of selecting the right point solution for insurance modernization. She highlighted the need to focus on a solution that not only brings value but can also integrate seamlessly into your existing ecosystem. Modernization efforts can be transformative, but choosing the right point solution is key. It's not just about finding a system that delivers value; it's about selecting a solution that can seamlessly integrate into your existing ecosystem and deliver immediate value.

Why Loss Control Should Be Your Next Function to Modernize

Loss control is emerging as the next critical area for modernization within the insurance industry. But why is it gaining such prominence?

Significant Value to Loss Ratio

Modernizing loss control can significantly impact your loss ratio. By implementing effective loss control measures, you can reduce the number of claims filed, leading to a healthier bottom line.

Modern loss control systems enable your teams to be more strategic in terms of identifying which customers are truly risky and in need of a physical visit or regular service. By optimizing this process, it ensures you’re touching the right customers and maximizing your impact vs. Spending time on “good risks”. Additionally, modern technology enables teams to collect risk data in multiple methods including low-cost mechanisms, creating environments where you can get risk data across 100% of your customers.

The power of loss control data is also significant, as when paired with claim data, actuaries can leverage these insights to better understand claim predictors. By implementing these predictors into your workflow, loss control can help you avoid significant losses.

Recent financial reporting shows that underwriting losses are accelerating while combined ratios are getting worse. There are limits to how much technology can help limit claims from natural catastrophes, or limit claims because of a nuclear verdict; but everyone agrees that better access to risk data can reduce the volume of avoidable losses and reduce the severity of claims when they do arise.

Improve Interaction with Policyholders for Increased Retention

Satisfied policyholders are more likely to renew their policies, boosting customer retention rates. Loss control is typically one of the only touchpoints outside of claims where a carrier speaks with the customer, so when loss control is positioned strategically as a value-add to the customer, it has significant value to customer satisfaction, broker satisfaction and retention rates. By helping address risks and providing content to insureds on how to remediate them, while providing good service, can dramatically increase your rates. Some companies who monitor this have seen upticks of 6-11% in their retention rate when they conduct loss control.

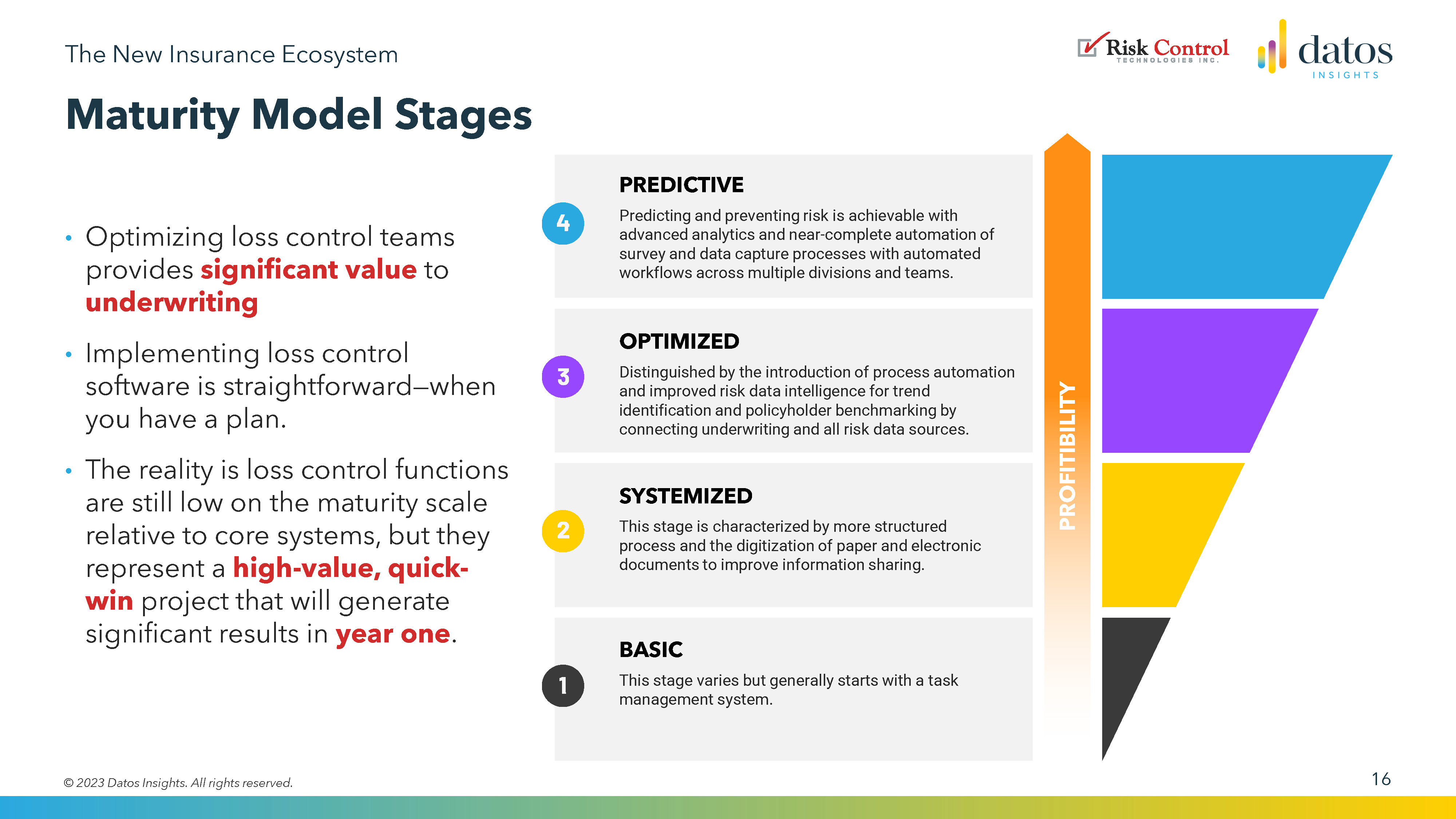

Continued Maturity on Your Terms

The flexibility of loss control modernization is a significant advantage. Understanding that most companies have a long laundry list of projects to pick from them, you can choose to invest in maturing your loss control systems at a pace that suits your company's preferences and resources. Each level of maturity offers its own unique set of benefits. For example, most loss control departments are still in an early maturity phase of their technology adoption and are often focused primarily on executing their primary responsibility of conducting physical surveys. However, they may only be servicing 8 to 12% of policyholders in their portfolio, in part because of the costs and time required to go in the field. Further, as demographics shifts and retirements accelerate it has become extremely difficult to replace risk professionals. So how can insurers respond to these challenges and opportunities?

Insurers can begin by modernizing the loss control technology to achieve several quick wins: increased coverage of the book of business, reduced costs to conduct surveys due to multiple survey options now available and increasing the number of touch points between insurers and their policyholders.

Maturing the loss control function will result in:

- Increasing coverage across the book of business to approach 100% (if required)

- Implementing optimizations and automations elevate your department to be hyper efficient

- Enabling data sharing and analytics across policy, claims and billing

- Automatically offering recommendations based on responses and risk factors

- Auto creating tasks for underwriting and loss control based on risk scores, survey statuses, recommendations, and more

Connecting to the Core Ecosystem

One of the advantages of prioritizing loss control is that it doesn't require extensive integrations from the get-go. Even at lower levels of maturity, you can start deriving value from your loss control system with minimal effort. Getting started with loss control doesn't have to be an overwhelming endeavor. You can begin by implementing solutions that require minimal integration efforts, allowing you to enjoy immediate benefits. In today's tech-driven world, having systems that simplify integration is crucial. Modern loss control platforms offer out-of-the-box connectors and public APIs, making it straightforward to plug into your existing ecosystem.

Loss Control in Practice: Skyward Insurance

Skyward Insurance provided real-world examples of the benefits of loss control modernization. They had clear business goals, and the implementation of loss control technology made a substantial difference in their organization, particularly in their core systems. Greco expressed how modern loss control technology can help position Skyward to improve efficiency, reduce claims, increase customer engagement, and leverage data to make better predictions about their loss experience. The system is also more tightly integrated with all their core systems and can therefore provide better accuracy on loss predictions.

Improving Efficiencies, Reducing Claims

The first phase of implementing a loss control platform focused on completing the digital transformation of the loss control process. Greco discussed how Skyward’s use of technology allows the team to automate various time-consuming tasks, such as scheduling phone calls, site visits, and other activities, thus allowing the team to focus their time on more customer centric activities.

Greco mentioned that his team is embarking on a project to create even more efficiencies through automation within his company’s loss control team. This project will automate everything from policy issuance to underwriting, to policy closing, and will provide valuable data for predictive modeling.

Leveraging Data – Out of the Box Integrations

Historically, Skyward had business units work with Loss Control Survey Vendors to collect data, but there was no data mining or analytics taking place. Greco shared how their loss control system integrates tightly into their core system, and the policy system feeds in new policy and renewal data, and if claims have occurred may bring in some claims data. The third-party risk data is also fed into the loss control platform, and the goal is to use predictive modeling to understand who should be serviced, when and through which channel. The answers can often also lead to varied automated loss control activities that are then communicated to claims, billing, underwriting or actuary depending on rules that they have setup. For example, in certain industries, lower premium accounts, or geographies where you don't have a team member located, might require you to automatically kick out an automated online self-assessment. These can calculate a risk score and send thank you letters, but also, based on risk scores or red flags, automate additional steps that drive further follow-ups. Skyward is now accumulating data by looking at near real-time and historical data to prevent future losses, price policies better and more competitively, and strip costs out of the business. Keeping quality records and data also allows insurers to better communicate the value that has been provided to a policyholder, such as through stewardship reporting or sharing improvements in their risk score over time.

Future Plans for Skyward

Skyward's journey with loss control modernization doesn't end here. They have exciting plans for the future, which include implementing further automation and integration. Greco mentioned that “when you have rich loss control data, including data from a larger data set of physical site visits, virtual surveys, and 3rd party data sources – you can leverage it in many different ways”. For example, integrating with claims data can create better predictors of risk than either data set in isolation. Greco sees this as the next step for his team as they pursue advanced automation. This forward-looking approach will not only enhance their usage of risk data but also improve efficiency throughout their processes.

Embrace the Future: Prioritize Loss Control

The modernization of loss control is the next logical step for insurance companies looking to thrive in a dynamic industry. The benefits are clear: improved loss ratios, higher customer retention, and enhanced operational efficiency. With modern loss control platforms offering seamless integration and tangible results, there's no better time to prioritize loss control modernization. Embrace the opportunity to transform your insurance operations and stay ahead in an ever-evolving landscape.

For additional insights into insurance modernization and the importance of selecting the right solutions, check out the full webinar.