RCT recently had the pleasure of hosting an insightful webinar on the evolving landscape of risk data in the insurance industry. The session featured Celent Head of North America Insurance, Karlyn Carnahan – AF Group Sr. Loss Control Compliance & Audit Specialist, Ryan Allen – and Risk Control Technologies (RCT) CEO, David Da Costa. The session brought to light the significant role that data plays in enhancing risk management practices and driving positive outcomes for insurance organizations. This blog recaps key insights from the discussion.

Celent Perspective: Current & Future Data Usage

Karlyn kicked off the session by sharing her journey of starting in insurance as a loss control engineer, in the days of handwritten reports and manual inspections. At the time, Loss Control was often viewed as merely the "eyes and ears" of the underwriter, focused on verifying information.

However, the industry has come a long way since then. Forward-thinking carriers have recognized the untapped potential of loss control data – it’s no longer just about ticking boxes during inspections; it's about leveraging data to drive strategic decision-making.

Underwriting and their data usage has become increasingly sophisticated, with an increased focus on tying data together from multiple sources. Generally, the data that Underwriters look for can be grouped into three main categories:

- Fixed Risk Characteristics – such as construction type, or the make and model of a vehicle

- Variable Risk Characteristics – such as roof condition, or property remodeling

- Behavioral Data – such as how an insured is using their cranes on a site, or the organization’s safety culture

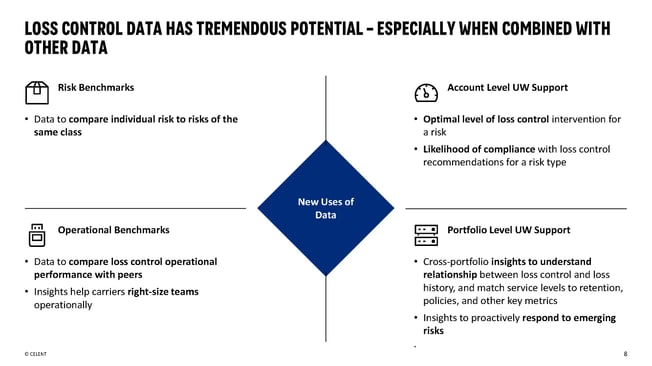

Karlyn also shared how as Underwriting becomes more data driven, there is an increased usage of data that is collected by Loss Control teams for both Predictive Modeling and Underwriting Judgement. This data has immense potential, and Karlyn shared four use case areas:

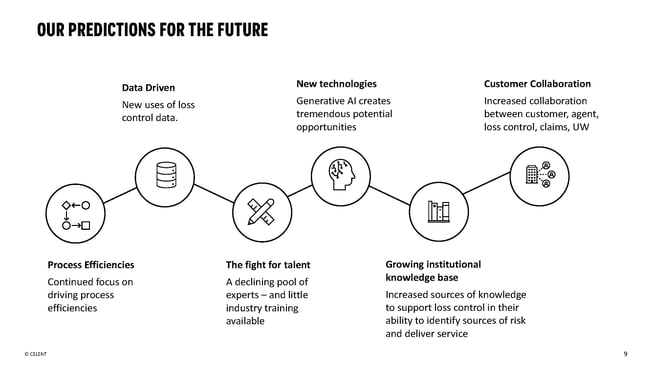

Before passing things off to Ryan Allen to share his experience and the evolution of risk management at AF Group, Karlyn shared some of Celent’s predictions for the future and how it pertains to Loss Control.

AF Group – A Journey of Transformation

Loss Control: A New Approach

Ryan delved into AF Group’s evolution, and the recognition that a more data-driven and business outcome focused approach would have a greater overall impact on company performance. Historically efforts were measured by activity/survey volume and viewed as a transactional process focused on compliance checks. This often left policyholders feeling disconnected, sometimes barely recognizing their loss control contacts or understanding the value of their recommendations.

AF Group’s approach to loss control has shifted towards a more dynamic and interactive model. This transformation is not just about adjusting methods but about redefining the relationship between insurers and policyholders.

The company has also moved towards a more proactive Loss Control discipline - focused on understanding and mitigating risks before they escalate into claims. It involves regular, meaningful engagement with policyholders, providing them with resources and tools to enhance their safety measures and risk management practices. Innovations such as virtual ergonomic assessments and the utilization of AI tools have become part of this new toolkit, enabling the company to offer more tailored and efficient services.

The Role of Technology

Ryan noted that the adoption of RCT’s system has been crucial for leveraging data for better risk assessment and management. The system allows for advanced scoring of risks based on various factors, including management commitment, safety implementations, and claims history. This data-driven approach facilitates targeted interventions, prioritizing policyholders who need the most support and ensuring resources are used effectively.

Enhancing Transparency and Communication

Transparency has significantly improved, with loss control data integrated into internal reporting systems. This change provides stakeholders across the organization with access to valuable insights about policyholders' risk profiles, fostering a culture of open communication and informed decision-making.

Results and Future Outlook

The transformation in loss control practices has led to tangible benefits, including improved underwriting profits, lower combined ratios, and higher satisfaction among policyholders and agents. Loss control has evolved from an afterthought to a strategic asset, integral to the insurance company's success.

RCT Perspective: Insight & Innovation

Next, RCT’s CEO David Da Costa, shared his vision for the future of Loss Control and RCT’s customers.

Addressing Economic Pressures

David explored how the current economic landscape, marked by rising interest rates and increasing expenses, is eroding profit margins across the insurance industry. This climate underscores the urgency for insurers to find ways to mitigate costs and enhance efficiency. Loss control emerges as a critical strategy in this context, offering avenues to reduce claims and operational costs.

Leveraging Loss Control Data

A focal point of Dave’s conversation was the potential of loss control data in predicting claims and enhancing decision-making. By analyzing this data, insurance companies can identify correlations between specific risk factors and the likelihood of claims, enabling more informed underwriting decisions and risk pricing.

The discussion also highlighted how a modernized loss control platform can facilitate better account selection and customer retention strategies. Understanding a customer's risk profile helps in tailoring services and interventions that not only mitigate risks but also strengthen customer relationships, leading to higher retention rates even in the face of premium increases.

Operational Efficiency and Innovation

Operational efficiency in loss control processes was another critical theme. The speakers pointed out that automating workflows and introducing scalable solutions can significantly reduce administrative overhead, allowing companies to expand their coverage without proportionally increasing headcount. Innovations like virtual assessments, self-surveys, and the use of third-party data sets can be cost-effective ways to collect risk data.

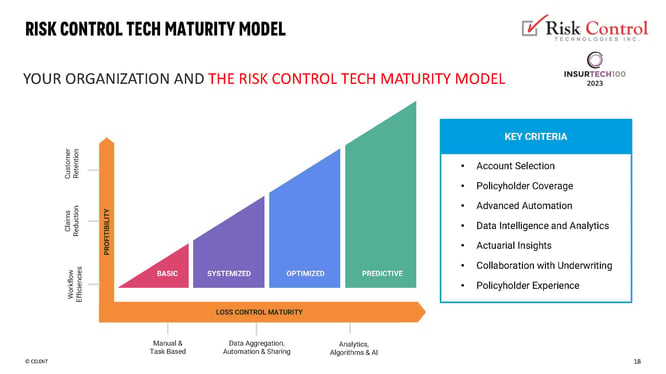

The Journey Towards Maturity

Dave explored the Loss Control Maturity Model, introduced by RCT in 2023 as a tool to both evaluate and empower companies at different stages in their operational sophistication. The Maturity Model evaluates Loss Control operations in four key stages (Basic, Systemized, Optimized, Predictive) and the corresponding impacts on company profitability through a variety of avenues. For a more detailed version of the model, please click here.

The RCT Customer Journey – Looking Ahead

The road map for evolving loss control practices involves understanding an organization's current position, setting clear objectives, and adopting technologies that align with these goals. RCT's approach to deploying their platform is designed to be configuration-based, allowing for quick integration and customization to meet specific needs, ultimately supporting insurers in scaling their business efficiently while managing risks and costs effectively.

Open Discussion and Q&A

The session ended with an open discussion and Q&A period, including:

- How do risk scores relate to service levels and loss reduction

- Risk scores impact service levels; lower scores suggest improvement areas. Implementing these improvements can enhance scores and reduce losses, showing a direct link between risk scores and loss mitigation.

- Risk scores impact service levels; lower scores suggest improvement areas. Implementing these improvements can enhance scores and reduce losses, showing a direct link between risk scores and loss mitigation.

- How have engineers adapted to analytics in their workflows?

- Initially resistant due to the impersonal nature of analytics, engineers grew to accept it through transparency and involvement in refining criteria, appreciating the objective insights that complement their expertise.

- Initially resistant due to the impersonal nature of analytics, engineers grew to accept it through transparency and involvement in refining criteria, appreciating the objective insights that complement their expertise.

- What advice is there for integrating analytics into loss control

- Start by evaluating the current state and plan for a data-driven approach. Prioritize data insights for risk assessment and involve loss control professionals to guide analytics-driven strategy development.

- Start by evaluating the current state and plan for a data-driven approach. Prioritize data insights for risk assessment and involve loss control professionals to guide analytics-driven strategy development.

- How can investments in advanced loss control systems be justified?

- Show the tangible benefits like better risk assessment accuracy, operational efficiency, and policyholder retention. Documented improvements in losses and customer satisfaction build a compelling case for these investments.

- Show the tangible benefits like better risk assessment accuracy, operational efficiency, and policyholder retention. Documented improvements in losses and customer satisfaction build a compelling case for these investments.

- What role will emerging technologies play in loss control's future?

- Technologies like generative AI will automate and refine risk management processes, offering efficiency and new insights. This promises a transformation in loss control towards more personalized and effective strategies.

To view the full session recording, please click here.