The 2023 Loss Control Summit, hosted by Risk Control Technologies, took place in late August at the Hotel X in Toronto. Focused on the themes of innovation, collaboration, and education, the fifth Loss Control Summit was a resounding success, providing a unique opportunity for the gathering of leaders in loss control.

This blog will review some of the key themes and recurring focus areas that came out of this year's Summit.

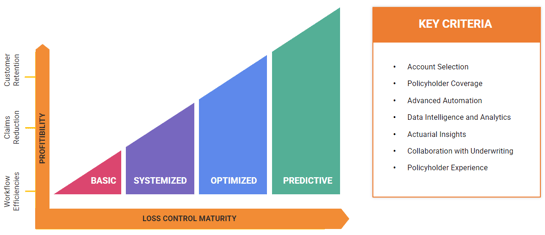

Loss Control Maturity

RCT's presented its Loss Control Maturity Model, how insurers can progress through the four maturity stages from basic to predictive, and how RCT can help them maximize their impact on loss ratios and customer retention. The model sparked engaged discussions and collaboration amongst attendees as they compared where they are now, and where they'd like to end up.

Maximizing Value & Cross Departmental Collaboration

A panel of six industry experts explored a wide range of ways that loss control impacts insurers, and how maximizing those impacts can create a competitive advantage (click here for a panel recording on loss control as a competitive advantage, featuring Datos Insights (Novarica), Skyward Specialty, and RCT). These included positively influencing loss ratios, quantifying impacts on customer retention, maximizing customer touchpoints and engagements, and implementing operational efficiencies not only within the loss control department, but for underwriting as well. This panel included:

- Eric Bourquin, VP Safety Services – Texas Mutual Insurance Company

- Jeff Spangler, Director of Loss Control Operations – Cincinnati Insurance

- Elizabeth Owens, Director, Risk Control & Consulting – HAI Group

- Ryan Allen, Senior Loss Control Compliance & Audit Specialist – AF Group

- Doug Alexander, Founder – A Brilliant Outcome

- David Da Costa, CEO – Risk Control Technologies

In addition, Carie Ferdani, Chief Operating Officer at Victor US & ICAT Catastrophe Insurance, explored through the unique lens of a catastrophe insurer, the utmost importance of accurate underwriting and data, in-depth risk understanding across the organization, and providing high quality response to events and claims.

Innovation & Technology in Risk Management

Rick Fineman, VP Loss Control at Berkshire Hathaway Homestate Companies, presented on the rapidly evolving digital revolution’s impact on safety and risk management. He explored current issues facing the industry, data impacts, emerging technologies, AI, change management, and how embracing technology can both improve your business and make the world a safer place.

Doug Alexander, Founder of A Brilliant Outcome advisory services delivered an engaging talk around the importance of building a culture of innovation in risk management. He discussed common challenges and internal objections to new innovations, leveraging your team, and best practices for getting started.Maximizing Human Capital

Christine Sullivan, SVP Risk Control at Sompo International and the 108th President of the American Society of Safety Engineers explored topics surrounding staffing challenges in the insurance industry, recruitment, and the importance of diversity. She addressed the ongoing difficulty of finding qualified loss control professionals, how insurers can make their organization more appealing to top talent, and how a diversified workforce benefits everyone through an increased talent pool, wider skill set, increased innovation and more.Necessities for Loss Control Software

In addition to the lineup of excellent industry speakers, the Summit explored several must haves for a modern loss control system. The days of purchasing systems for the sole purpose of increasing efficiency are long gone as insurers look to do more, and get more, from their technology. Some must haves include:

- A clear roadmap to help insurers progress along the Loss Control Maturity Model and towards a predictive state

- Cutting edge workflow automation capabilities to create significant workflow efficiencies within Loss Control and Underwriting.

- Advanced risk scoring to aid in predicting claims and improving loss ratios

- World class analytics and business intelligence tools to better predict risk, monitor customer health and retention, improving pricing and more

Industry Leading Organizations

The Loss Control Summit also provides an opportunity to recognize world class insurers through RCT’s fifth annual customer awards. These awards recognize organizations and individuals leading the charge in the industry, as well as pushing RCT and its products and processes forward. Congratulations to:

- BITCO Insurance Companies and Great West Casualty Company, Implementation Excellence Awards

- Texas Mutual Insurance, Innovation Vanguard Award

- AF Group, Brand Ambassador Award

- Great American Insurance Group, Tech Mastery Award

- Skyward Specialty Insurance, Transformation Leader Award

Creating Connected Ecosystems

For today's insurers, a crucial aspect of any software solution's success is its ability to fit into a connected ecosystem. Gone are the days of systems that live in isolation, as interconnectivity is crucial to enabling cross departmental collaboration, data sharing, and providing a single source of truth across the organization. We were pleased to be joined at this year's Summit by industry leading software and service providers, that also aim to amplify the impact of loss control and RCT's systems. These include Guidewire, Duck Creek Technologies, Bees360, EXL, and Zero Accident Consulting.

Attendee Feedback

“The Summit offered a very good mix of various topics and ideas at a fast pace. The networking was excellent.”

“I appreciate the investment on the part of RCT and the opportunity to collaborate and be heard. The exchange of ideas and sentiments among peers that attended was quite valuable.”

“Very enjoyable and informative. Networking events were wonderful. The educational and soft skill presenters kept the day moving forward. Venue was wonderful.”“This was an exceptional opportunity for us to network with other users, hear best practices, and explore new options. Very well done.”

“Was very impressed with what I saw, loved how engaged a lot of your clients are. Really liked the breakout session where clients gave suggestions on new features.”

Thank you to everyone who attended, spoke, shared ideas, and helped to make the Summit special. We look forward to seeing you next year!

For updates on future events, please visit www.losscontrolsummit.com.